Access a suite of logos, fonts and media resources for the AdvisorEngine Brand. If you can’t find what you need, please contact us.

Access a suite of logos, fonts and media resources for the AdvisorEngine Brand. If you can’t find what you need, please contact us.

Run your firm on a modern, open technology stack

-1.gif?width=600&height=600&name=ezgif.com-gif-maker(1)-1.gif)

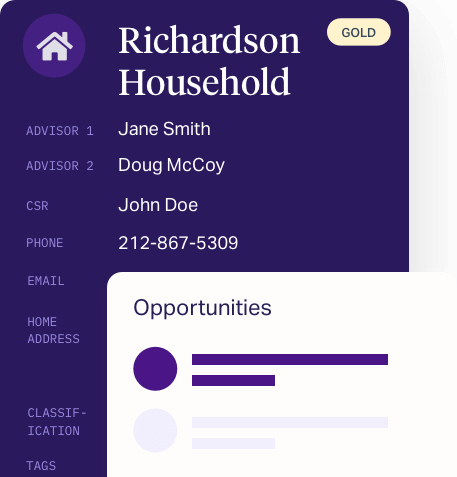

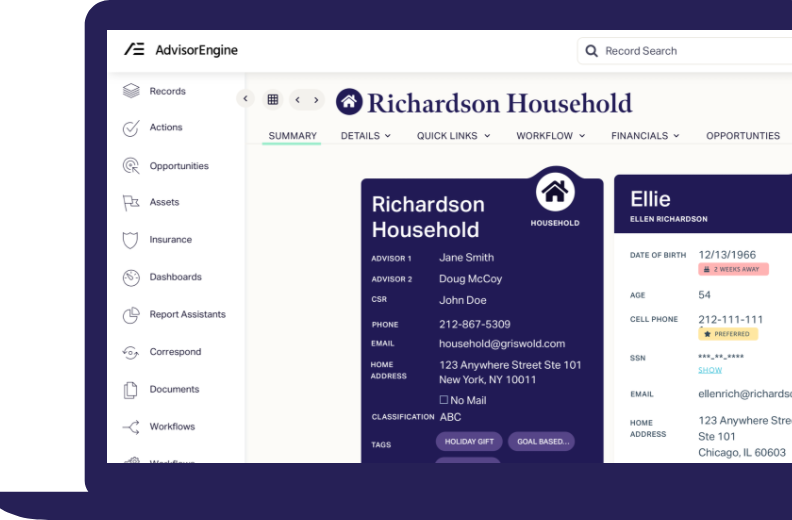

Operational excellence requires a purpose-built CRM.

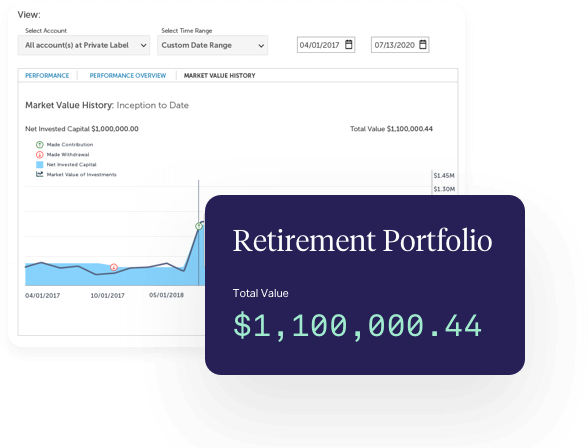

You control report creation, scheduling and automated delivery, keeping everyone on the same page.

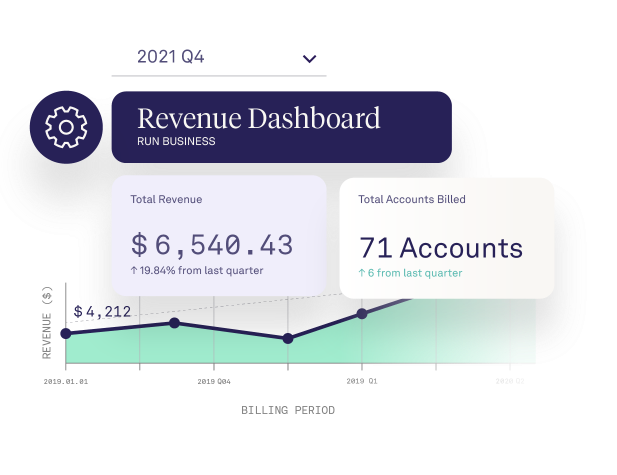

Some tasks require your regular attention – billing should not be one of them.

Implement your investment philosophy via order management, trading and rebalancing tools.

Fund new accounts in minutes. Modernize your proposals, risk profiling and more.

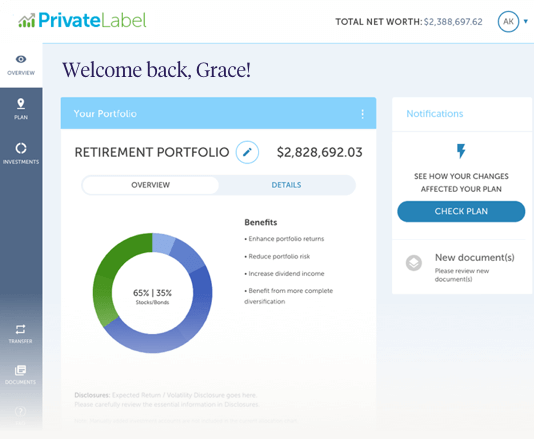

The client experience you would build if you started from scratch.

Stop relying on spreadsheets to track your results. View your key inputs and drivers.

Operational excellence requires a purpose-built CRM.

You control report creation, scheduling and automated delivery, keeping everyone on the same page.

Some tasks require your regular attention – billing should not be one of them.

Implement your investment philosophy via order management, trading and rebalancing tools.

Fund new accounts in minutes. Modernize your proposals, risk profiling and more.

.png)

The client experience you would build if you started from scratch.

Stop relying on spreadsheets to track your results. View your key inputs and drivers.

.png)

.png)

Don’t just take notes – take action. Set up workflows to scale your team’s daily tasks.

.png)

Learn about the forces of change at work in our industry and how to prepare your business.

By working with us, you’re partnering with people who appreciate what it takes to operate a world-class financial advisory firm. We love what we do and we are here to help your team deliver.