I’m a millennial. So it should come as no surprise that I like texting.

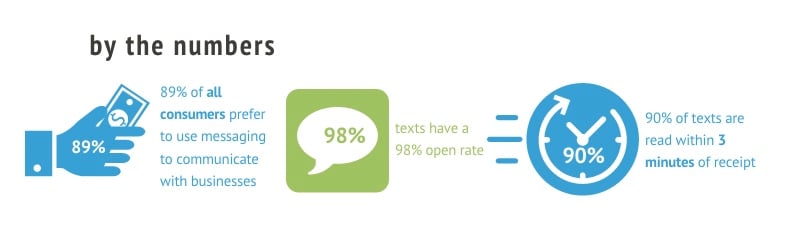

But it’s not just millennials who prefer texting as their go-to form of communication. Did you know that 89% of all consumers prefer to use messaging to communicate with businesses? Texts have a 98% open rate and 90% of these are read within 3 minutes of receipt. These numbers are astonishing.

It’s no wonder that financial advisors are thrilled with Junxure®’s latest integration with MyRepChat. MyRepChat reports this new integration allows advisors to communicate with clients via text while fulfilling important compliance requirements.

The history of MyRepChat

Junxure and MyRepChat share a common founding thread - they were both created by an advisor, for advisors. Junxure’s founder, Greg Friedman built the CRM software because nothing existed like it in the marketplace. Likewise, Derrick Girard built MyRepChat because he believed no platform was available where he could text his clients compliantly.

The aha moment occurred when Girard received some text messages from his clients. He told his clients that it was against the rules to exchange a text; yet, they didn’t seem to care about the rules. He did some research and realized there was no client communication solution in the industry built for advisors directly. And here’s the key: it had to facilitate compliance approval.

Why MyRepChat

I caught up with our Product Manager in charge of this integration, Jason Kissinger, and he described what sets this platform apart from the rest, “MyRepChat has all the features advisors and compliance officers need to help run their businesses better.”

Kissinger continued, “Being compliant as a firm is obviously of paramount importance, and so is being able to communicate with clients in a seamless way – this [integration] marries those two things together. People who want that next-level compliance solution to track conversations via text messages in their CRM directly, now have the ability to do so.” Here are just some of the features of MyRepChat:

-

Text and group messaging

Clients never have to download an app or software to communicate with you.

-

Digital assistant

Scheduled, automated, and efficient client communication - leaving you more time to do what you do best.

-

Compliance features

MyRepChat communicates directly with your compliance department and your preferred archiving system - ensuring your messages are properly monitored and retained.

-

Import your contacts

Import your contacts from your CRM or your mobile phone and begin texting immediately - conversations will be instantly archived in your CRM.

-

Scheduling function

You can plan and schedule messages in the future and create recurring messages to celebrate important dates - push send once, and be worry-free while executing important marketing tasks.

-

Auto-forward

If you don’t have a landline number to text enable, a text number is auto-generated for you – in addition, all calls will be auto-forward to the number of your choice.

Feedback from early integration users

We were able to test market this integration before our wide-scale rollout - I am pleased to report that we had nothing but positive feedback from our early users.

"We will be able to easily integrate this product with Junxure. It's user-friendly, offers improved client experience and saves us a lot of time," said Sheila Foxx-Epps, Applications Support Analyst with Sage Rutty & Co. Who wouldn’t want an improved client experience? Happy clients are essential for retention and growth.

Ayasha Jones, Director of Operations at BlueSky Wealth Advisors explained, “MyRepChat gives us another communication channel to connect with our clients while still complying with regulations.”

When asked what factors led to the decision to implement this integration, Jayne Bills, Compliance Professional at Berkshire Money Management, responded, “Compliance, client service, communication and efficiency.” All are so important to running a successful advisory practice.

Next steps

If you are not taking advantage of compliant texting, it’s time you should.

This latest integration with MyRepChat is just another example of how AdvisorEngine and Junxure deliver on that modern experience for everyone - advisors, operations personnel and clients alike.

This blog is sponsored by AdvisorEngine Inc. The information, data and opinions in this commentary are as of the publication date, unless otherwise noted, and subject to change. This material is provided for informational purposes only and should not be considered a recommendation to use AdvisorEngine or deemed to be a specific offer to sell or provide, or a specific invitation to apply for, any financial product, instrument or service that may be mentioned. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of AdvisorEngine and are subject to change without notice. AdvisorEngine makes no representations as to the accuracy, completeness and validity of any statements made and will not be liable for any errors, omissions or representations. As a technology company, AdvisorEngine provides access to award-winning tools and will be compensated for providing such access. AdvisorEngine does not provide broker-dealer, custodian, investment advice or related investment services.