For decades, the idea of computers seemingly becoming sentient and engaging with humans was incorporated in comics, books, television and movies.

These computers and animatronic figures played games, controlled spacecraft, and generally sought to ease the lives of those with whom they interacted. These fictional characters were largely based on technology that was developing concurrently with the rise of media. While to many of us they seemed like fanciful characters at the time, we believe these ideas are now entering the mainstream reality of our day-to-day lives, bringing new opportunities for growth and productivity across a wide range of industries.

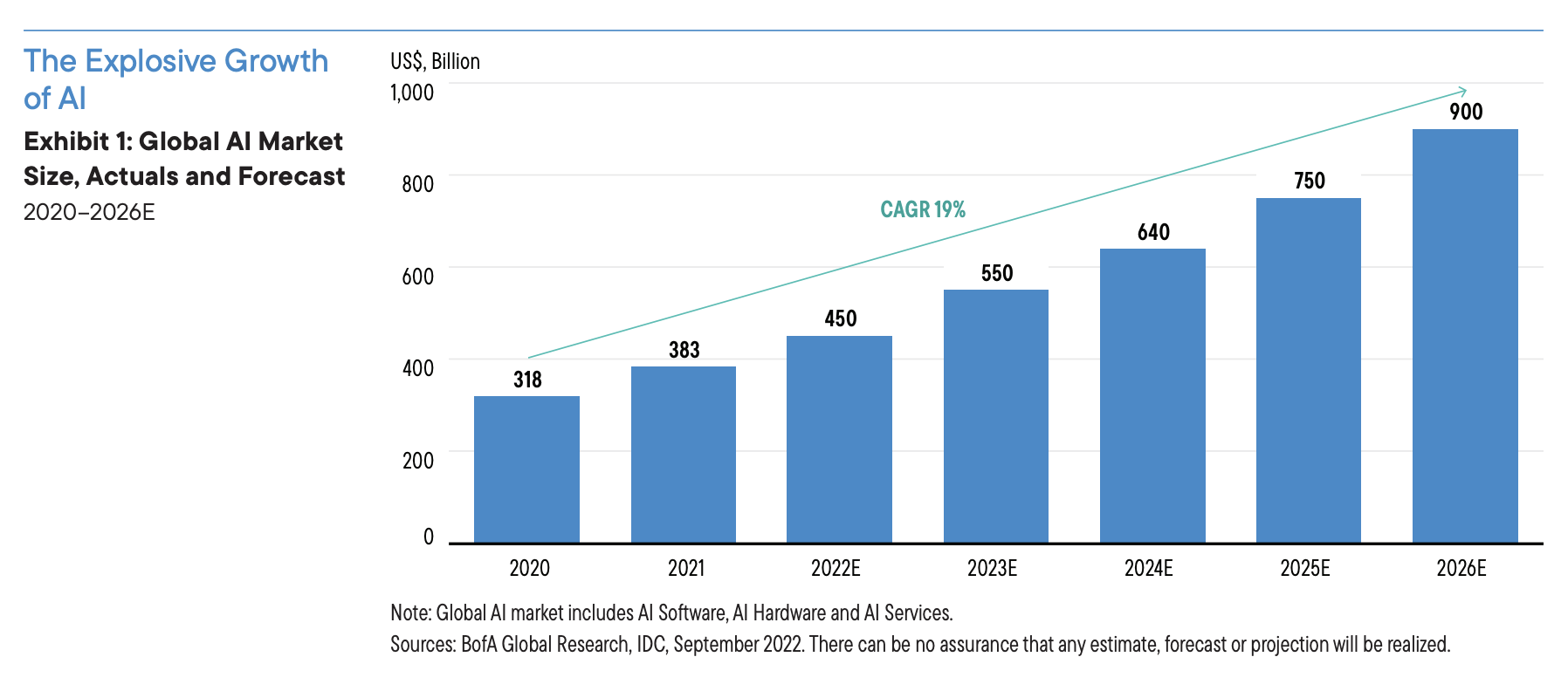

AI technology has been in development since the 1950s, but it wasn’t until the late 1990s that it started to become more widely used. Early forms of AI in the 2000s focused on business intelligence and machine learning and saw rapid enterprise adoption. Since 2017, AI adoption has more than doubled globally (Exhibit 1) as companies have embraced the potential that the technology unlocks. The increase in computing power and ability to analyze large data sets and build predictive models has been a tremendous driver of productivity gains not just for the technology sector, but for every industry around the globe.

The next wave of AI has arrived and is driven by natural language models, like the recently released Generative Pre-Trained Transformer (i.e., ChatGPT). These models combine large amounts of data and computing power to string together words in a meaningful way. They understand words in context and have a vast vocabulary and information. They bring the promise of AI to act as an assistant for many human tasks closer, than ever before.

What is ChatGPT?

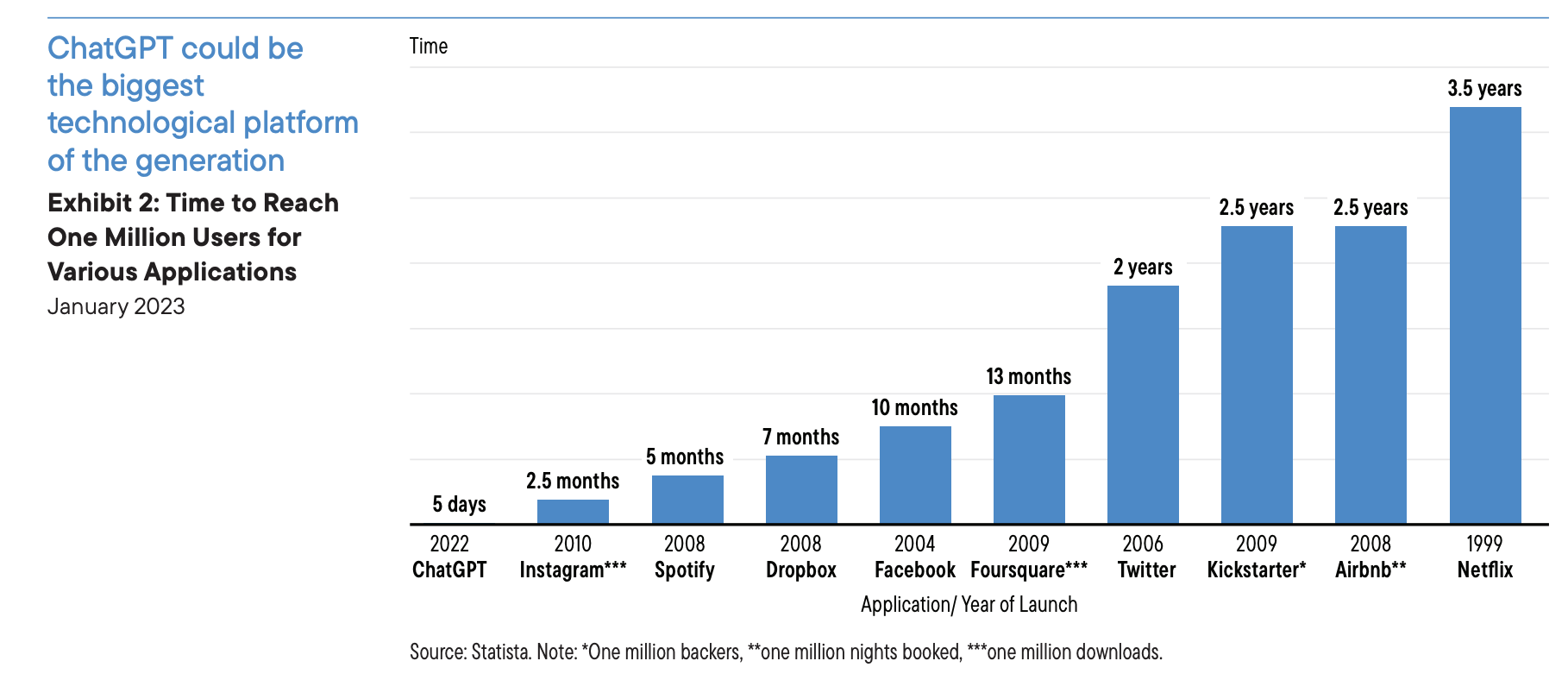

In late 2022, OpenAI, an artificial intelligence company that was founded in 2015 by several technologists including Elon Musk and Sam Altman, released its latest version of their AI platform ChatGPT. The platform uses Open AI’s GPT language technology and can understand and create human-like conversation. The platform quickly reached over 1 million users in one week and Microsoft CEO Satya Nadella called it “the biggest technological platform of the generation.”

ChatGPT is a natural language model developed by Open AI, which is based on the GPT architecture. The model has been trained on a massive amount of text and data from the internet, books, and conversations. It can understand a wide variety of topics and can perform a wide range of natural language processing tasks such as text generation, text summarization, question answering and language translation. The model has been praised for its ability to predict what word should be next in a sentence and to generate human-like text, which makes it ideal for use in chatbots. ChatGPT is continuously learning, allowing for ongoing improvement in its ability to generate relevant content.

An example of this evolution can be exemplified through automated customer service chat bots—currently, when customers interact with a chatbot on a website, the chatbot generally uses canned responses when customers are initiating a return, trying to change their cable services, trying to purchase airline tickets, etc. These chatbot experiences are stilted in nature and have limited information scope. ChatGPT and other related large language models (LLMs) advancements could improve the fluency of communication between humans and computers with a broad set of applications, like automatically providing transcripts of work meetings, creating schedules to increase productivity in workplaces and drafting emails.

Economic impact and the AI investment universe

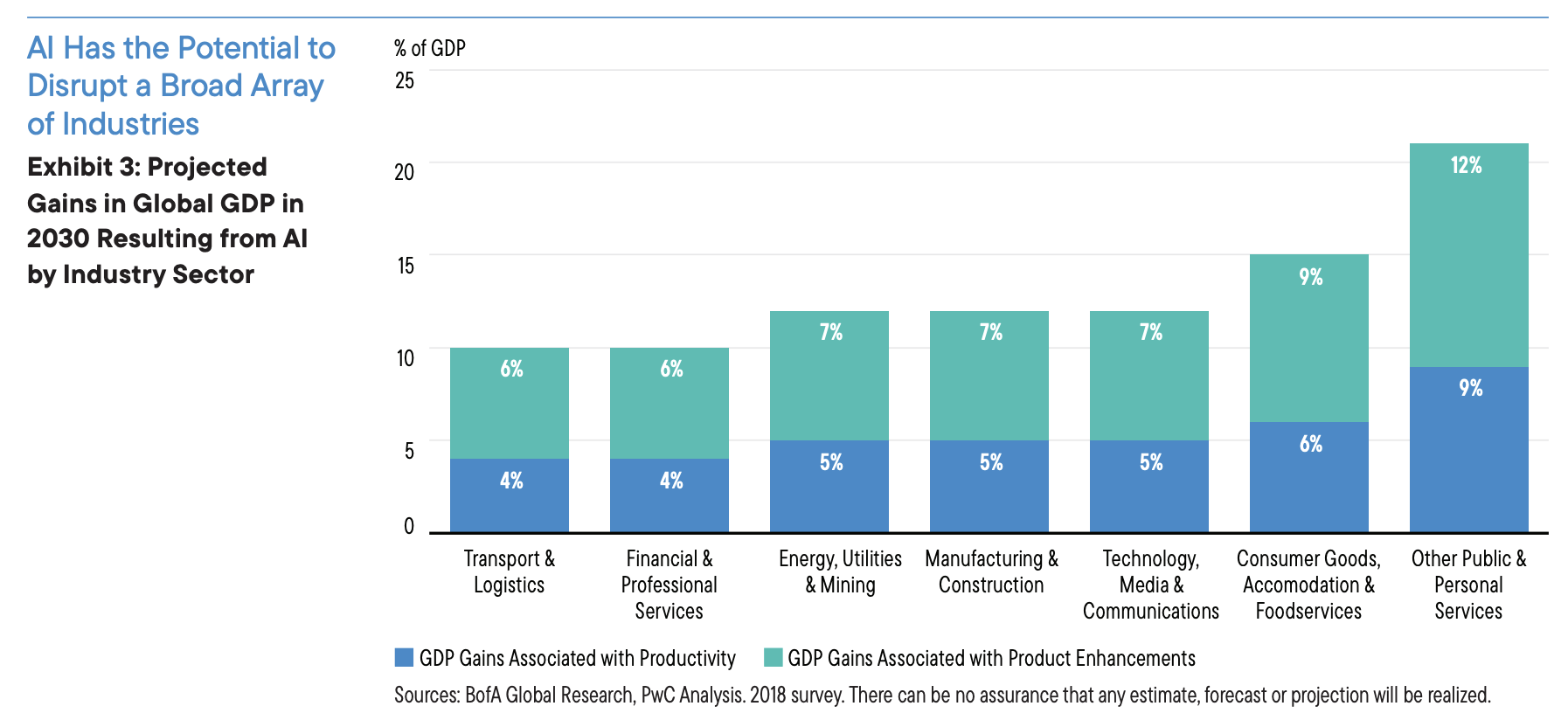

The potential market for AI is enormous, as the technology has the potential to disrupt a wide range of industries (Exhibit 3). PWC estimates that AI could contribute up to US$15.7 trillion to the global economy by 2030,1 more than the combined output of China and India. The following will likely drive the primary economic impact:

- Productivity gains from businesses automating their processes (including the use of robots and autonomous vehicles).

- Productivity gains from businesses augmenting their existing labor force with AI technologies.

- Increased consumer demand from the availability of personalized AI enhanced products or services.

What industries might be disrupted first?

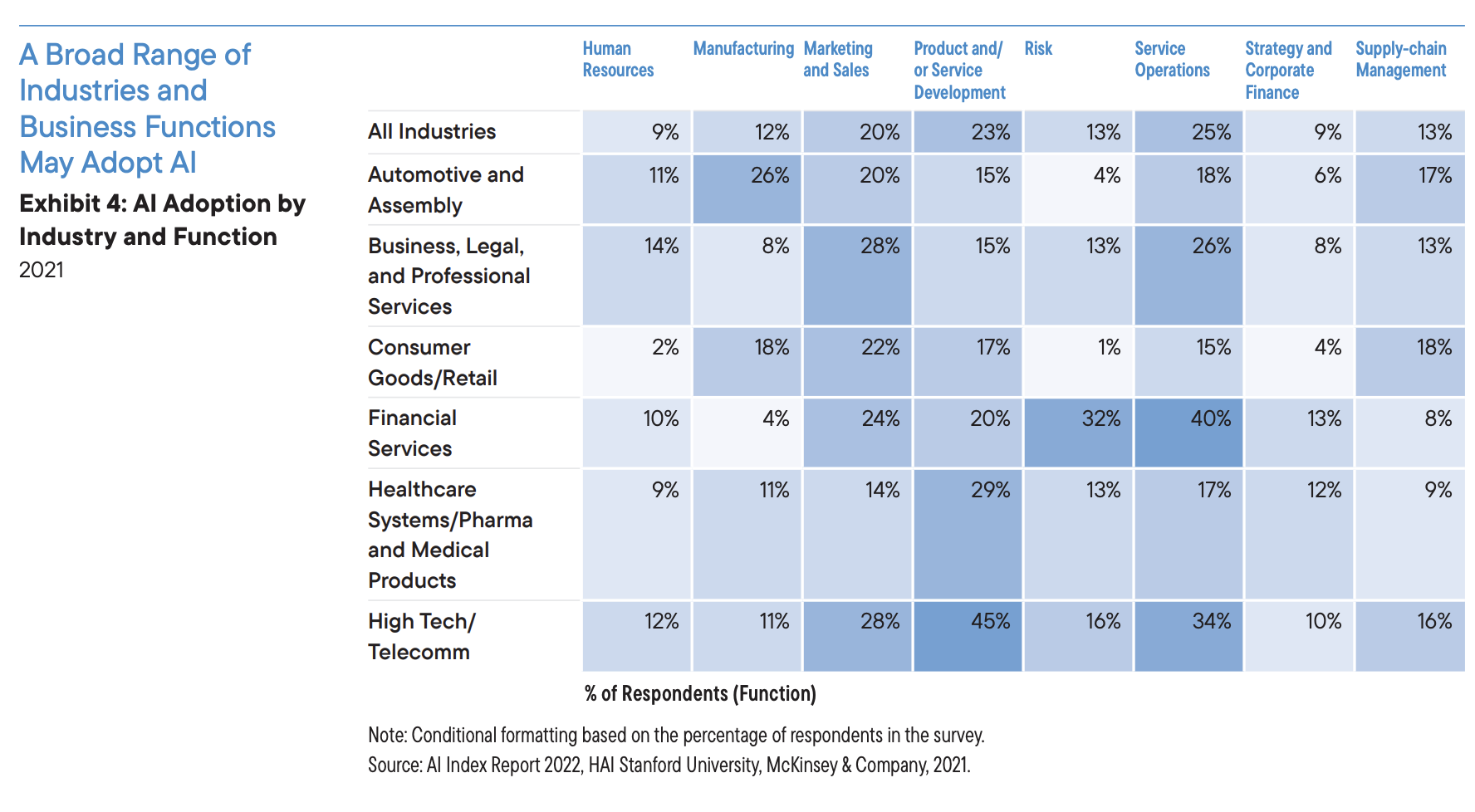

Artificial and machine learning should be thought of as “enabling technologies”—in other words, technology that must be paired with something else to be useful. We believe that these models will be disruptive to a multitude of sectors, and we see massive opportunity in how sectors may incorporate AI for greater productivity potential. Companies are just starting to think about how to leverage this technology to foster improvements in their business models and customer engagement. Just as the launch of the iPhone in 2007 unleashed the last great technology shift to mobile, we expect a wave of productivity improvements to be seen across the entire market (Exhibit 4).

Health Care

The healthcare sector is one area that could see significant change from the new AI models.

- Democratized health care access: Generative AI and its user-friendly interface has the ability to democratize access to health care for patients by analyzing symptoms and providing personalized treatment plans. This can improve the quality of patient care and reduce health care costs.

- Improved patient care and drug development: AI can also improve the standard of patient care by being the primary point of review for standard tests such as X-rays, lab results, drug development and MRIs. A hypothesis-driven discovery method currently drives drug development, which is both a time- and money-extensive endeavor. However, AI could enable analysis of large swaths of data to expedite and enhance the research and development process. One company used AI to observe the progress of various cancers by following data from cancerous and non-cancerous cells created. Other companies are investigating how to integrate machine learning into their research processes by using predictive technology to determine how potential drugs could impact the body, and then filter out less-effective compounds before lab work begins.2

Technology

Large language models could be very disruptive to several areas of the technology sector.

- Internet search: Even though many people may use the same internet search provider, each person’s internet experience could be vastly different, due in part to AI learning of people’s tendencies and creating a tailored experience. Traditional online search is one of the areas the arrival of generative AI may transform. The current search model is advertising-driven; in other words, what shows up at the top of a user’s search may not always match exactly what that individual is looking for, because it’s paid content. Generative AI technology offers a more conversational model able to deliver search answers directly to the user, using a language model to retool how search engines rank and serve relevant information.

- Coding and software development: Recently released software programming copilot products such as Microsoft’s GitHub Copilot and Deep Mind’s AlphaCode leverage large language models to act as assistants or guides for software development – automating and improving code quality. We believe that there could be a transformation in the coding landscape, transforming a currently labor-intensive exercise to a more automated one. In the years ahead, we see these copilot products being integral to the coding and software development process.

Retail and customer service

Anticipating customer needs and streamlining the service pipeline.

- Retailers are beginning to use AI to anticipate demand and, taking it a step farther, to use deep learning to predict customers’ orders in advance. We believe this will drive more on-demand customization for consumers. This AI-driven customization should contribute to improvements in customer loyalty, which ultimately drives a virtuous circle of more demand.

- AI-driven chatbots are poised to disrupt the customer service industry. With the ability to provide instant responses to queries, chatbots can reduce wait times and improve overall service levels at lower cost. The travel, transportation and retail industries have been early adopters of AI technology and will embrace the new abilities GPT (and other LLMs) bring.

Automotive, transportation and education

Improving autonomous driving and new learning experiences.

- Autonomous or semi-autonomous driving will be built on the backbone of AI. Currently, we see many driver assistance or collision avoidance systems utilizing AI. In the not-too-distant future, we expect to see autonomous ride-sharing fleets in cities and large trucking companies using AI to manage transportation networks.

- The education sector could see disruption as large language models provide students with personalized learning experiences, answering questions or even writing papers for them. It also opens the door for teachers and students to rethink core skills instruction and development to identify and reinforce conceptual learning without over-reliance on these new tools.

Investment opportunities in AI

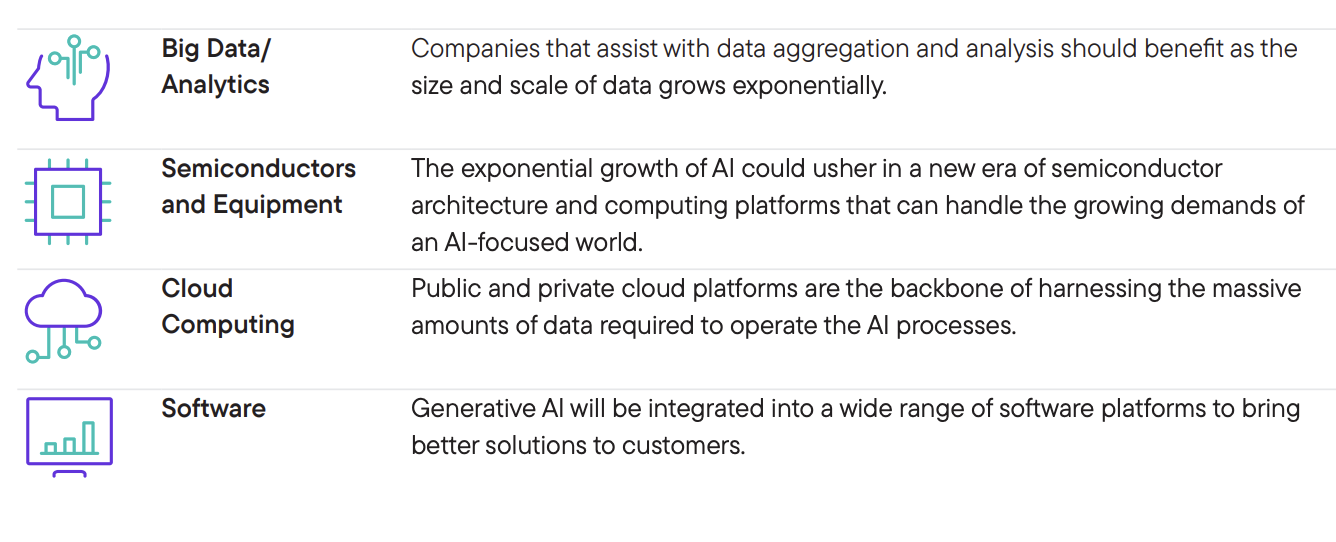

In our view, structural shifts in the technology landscape often create attractive investment opportunities for long-term investors who can position portfolios to take advantage of these shifts. AI represents a set of technologies, but many wonder how to invest in it. AI is under development at multiple large companies for a variety of purposes, including most large technology and technology-related companies, either as standalone products or as ways of improving existing products and business processes. Machine learning (ML) technology – a branch of artificial intelligence that enables computers to emulate how humans learn and adapt by using data and experience – is also under development at many companies, including semiconductor industry players situated at the core of ML/AI computing power. Additionally, as technology generally becomes more pervasive across industries, companies outside of the traditional information technology sector may have exposure to or are investing in AI.

Below are a few examples of areas of opportunity we see.

Long-term opportunities of AI

The “Age of AI” is fast approaching, and we believe that these changes will make AI integral to everyday life, interwoven in how we interact with computers. However, like many technologies, we believe the adoption will be moderate at first and build over time. Technology will continue to improve. Investment will grow, and more applications will be built on the platforms. Enterprises and consumers will realize the benefits of the tools built based on this new technology. We are excited by the tremendous opportunities that AI, ChatGPT and other large language models bring and will continue to search for opportunities for our strategies to invest in the revolution.

1. Source: Rao, Anand S. Verweij, Gergard. “Sizing the prize. What’s the real value of AI for your business and how can you capitalize?” PWC 2017.

2. Source: “Artificial Intelligence in Health Care.” GAO. December 2019.

This blog is sponsored by AdvisorEngine Inc. The information, data and opinions in this commentary are as of the publication date, unless otherwise noted, and subject to change. This material is provided for informational purposes only and should not be considered a recommendation to use AdvisorEngine or deemed to be a specific offer to sell or provide, or a specific invitation to apply for, any financial product, instrument or service that may be mentioned. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of AdvisorEngine and are subject to change without notice. AdvisorEngine makes no representations as to the accuracy, completeness and validity of any statements made and will not be liable for any errors, omissions or representations. As a technology company, AdvisorEngine provides access to award-winning tools and will be compensated for providing such access. AdvisorEngine does not provide broker-dealer, custodian, investment advice or related investment services.