Empowering advisors to invest, connect, grow and scale.

Joseph Konrad was once a financial advisor. Today he is building technology tools for financial advisors at AdvisorEngine. As a product manager focused on data, he finds his past and present roles feed into one another.

“People ask me, ‘What do you do?’ Sometimes I say I work for a software company, and sometimes I say I work for a financial services company,” Konrad says. “To deliver for today’s financial advisors, it takes technology and finance know-how.”

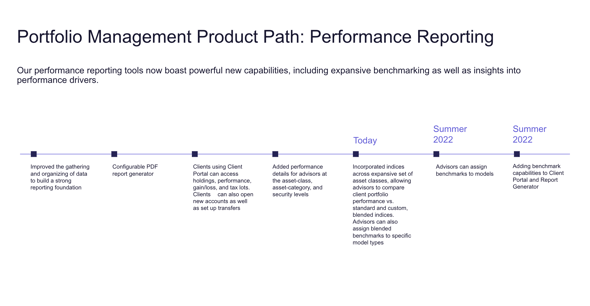

Konrad is one of dozens helping develop AdvisorEngine’s latest offering, an upgraded portfolio management suite as part of the company's wealth management platform. The new functionality delivers across three core categories of portfolio management: performance reporting, rebalancing tools and fee billing.

What advisors need

Robust portfolio management power is essential for today’s advisors challenged to provide personalized client service and operate efficiently, says Patrick Arnold, AdvisorEngine head of product.

Arnold explains his team set out to accomplish three goals with the suite:

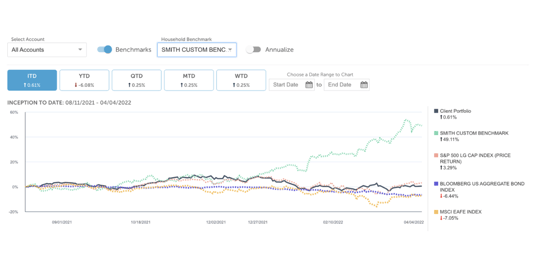

- Deliver powerful analytics for portfolio insights and performance reporting

“As an advisor, client account performance is always top of mind. You never want to get a phone call where someone has underperformed and you didn’t know about it. The suite’s reporting tools ensure that never happens.”

- Create simple, tax-efficient rebalancing tools that optimize portfolio performance

“You can achieve scale by optimizing portfolio performance through streamlined processing, click-to-execute simplicity and tax-efficient automation.”

- Provide users with automated billing with an array of fee collection options

“No more scrambling at the end of every billing cycle to pull together a ton of portfolio information for fee calculations.”

With all three categories connected through workflows, Arnold adds, it’s easy for the advisor to track and execute all actions. The suite provides the foundation for powerful business intelligence reporting, too.

“From the onset, we have focused on creating a fully integrated platform where data can flow seamlessly from module to module -- and we have invested heavily in the infrastructure to make that happen,” Arnold says.

A platform path

Over the past 18 months, AdvisorEngine’s product managers and designers collaborated with software engineers and testers to build out the portfolio management suite of tools.

The evolution of AdvisorEngine’s wealth management platform, though, can be traced back to its beginning vision. Company founder and CEO Rich Cancro witnessed the frustration advisors faced being bogged down with manual practice tasks that ate away at time they needed to spend with clients. Cancro’s goal when he started AdvisorEngine was to develop a platform that connected all of an advisor’s daily tasks into simplified, automated workflows.

“All of the basic building blocks that make a wealth management platform – including digital onboarding, a client portal, a billing engine, performance measurement, modeling, rebalancing and compliance elements – gradually fell into place,” Konrad says. “We grew organically, by gathering feedback along the way from our clients. This is the space we want to compete in, and we have been very deliberately building toward that.”

“This incremental evolution allowed AdvisorEngine to build a lot of detail into each aspect of its portfolio management suite,” he adds, “much like a custom car garage fine-tunes every component that goes into their specialized vehicles.”

‘Hands-off' connectivity

Patrick Arnold, head of product development at AdvisorEngine, notes the team built account onboarding, for instance, to work across all four major custodians, and includes a long list of activities aside from account openings, such as ACATS, one-time and repetitive cash withdrawals, account consolidations, and required minimum distribution forms.

“Our differentiator is how deeply integrated we are with the custodians,” Arnold says.

For instance, Arnold notes that with billing, AdvisorEngine’s platform produces invoices and fees and leverages integrations with a custodian to debit the investor accounts and credit the advisor and house accounts. End clients request a withdrawal, which is automatically fed into the rebalancer to raise the required funding. The platform automatically delivers the request to the custodian for withdrawal once the balance is raised from the submitted order.

Enhanced reporting

Other extra steps the team took include building the performance engine to align with guidelines that promote full disclosure and fair representation of investment performance; and building the capability for the engine to not just calculate the performance of accounts and households but also performance of asset classes, asset categories and individual securities.

The team also enhanced performance reporting capabilities to deliver information in three forms: within the platform for advisor analysis, in the client portal for the end client, and in a report packager – which automatically generates custom PDFs for advisor's clients.

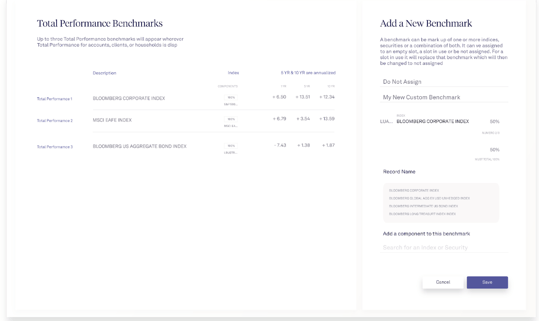

One major addition to AdvisorEngine’s portfolio management capabilities is benchmarking. The work involved setting up licensing agreements and building out another round of integrations with major benchmark providers. Arnold says he’s very proud of these enhancements not only because the team added these major benchmarks, but it also considered at length how advisors would want to use the information so that they could deliver options for advisors to customize and configure institutional-level data.

To follow a stock’s performance in a portfolio, any analysis must look at the history of the position in the account, including contributions and withdrawals and pricing and market value history. The performance engine built by AdvisorEngine is able to handle the mass of calculations involved to do it accurately and quickly.

“Let's say you have 30 securities in an account over the last two years. That adds up to thousands of positions,” Konrad says. “That's a lot of math. We do it internally and that's all programming.”

Industry data authorities

What helps AdvisorEngine achieve this level of detail is the wealth management industry knowledge built into the team, Konrad notes.

“We are really good at going through data because we understand the data,” Konrad says.

“There are very few nooks and crannies of this industry that we don't have someone in our firm who understands it well,” he adds. “We know how to calculate it; we know how to analyze it, draw conclusions, and present the data in an easy-to-understand format. This is not just something anybody can do. You need people who understand the industry, who’ve got that dirt under their nails.”

The team also constantly pursues updates, upgrades and testing of all software, Konrad explains, to ensure tools work exactly as advisors need them to and reflect requirements in an industry subject to changing regulatory demands. To that end, his team keeps a regular quality assurance schedule examining existing features and new products.

Delivering better client experiences

Arnold says these accomplishments flow from AdvisorEngine’s emphasis on design thinking.

“You’re starting with client conversations to understand what goes on in their office and then working with product managers, product designers and business analysts at the same time to build out prototypes.

“You’re not getting business requirements, throwing them over the fence to design to give you a mockup, then throwing it over the fence to tech to build it. We're working together in teams to build a client experience to solve a problem.

“We've found that results in a much better client experience, and we’re delivering connected workflows and solving actual problems rather than building features and leaving it up to clients to figure out how to put them all together to solve their problem.”

If you’re interested in learning more about how AdvisorEngine’s portfolio management suite of tools can help your business, you can set up a time for a demo here.

This blog is sponsored by AdvisorEngine Inc. The information, data and opinions in this commentary are as of the publication date, unless otherwise noted, and subject to change. This material is provided for informational purposes only and should not be considered a recommendation to use AdvisorEngine or deemed to be a specific offer to sell or provide, or a specific invitation to apply for, any financial product, instrument or service that may be mentioned. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of AdvisorEngine and are subject to change without notice. AdvisorEngine makes no representations as to the accuracy, completeness and validity of any statements made and will not be liable for any errors, omissions or representations. As a technology company, AdvisorEngine provides access to award-winning tools and will be compensated for providing such access. AdvisorEngine does not provide broker-dealer, custodian, investment advice or related investment services.